A former partner of the venture capital giant Khosla Ventures, Andrew Chung, today launched his own venture firm, 1955 Capital. The fund, which has raised $200 million at first close, will invest in startups in the energy, food and agriculture, education and health sectors.

Forbes: With $200 Million, New Venture Firm 1955 Capital Plans To Bring Western Tech To China - Forbes

Andrew Chung hasn’t had the easiest job in venture capital. For the past ten years, the investor has maintained his focus mostly on cleantech startups when the majority of his VC peers have long since abandoned that market for companies that don’t burn through so much cash. He began first at Lightspeed Venture Partners and most recently at Khosla Ventures.

Newly Formed 1955 Capital Launches With First Close of $200 Million

Los Altos, CA, Feb. 24, 2016 – 1955 Capital announced the launch of its venture capital firm with an initial close on $200 million in anchor commitments, exceeding its initial target and making it one of the largest first-time independent venture firm launches in recent years. The firm will invest in technologies developed in the Americas and Europe that can help solve the developing world's greatest challenges in areas like energy, food, agriculture, health, education and sustainable manufacturing. 1955 Capital is founded and managed by Andrew Chung, a former partner at Khosla Ventures, with extensive experience and success investing in these sectors and commercializing numerous technologies in China and other regions.

It’s Time for Something New

Last year, I went to a dinner where Madeleine Albright was the guest of honor, and she said some things that really resonated with me: The U.S. and China are more codependent on each other than any two countries have ever been in history. There’s no escaping the fact that we need each other. More importantly, we need to find the right way to work together.

That’s why the launch of 1955 Capital is so important to me. It’s a new venture firm I founded focused on funding technologies in developed countries that can be rapidly commercialized and scaled to solve pressing challenges in the developing world — starting with China.

We’re talking about taking on big, bold challenges like air pollution, renewable energy, food security and safety, health care delivery, accessible education, and sustainable manufacturing. I’ve watched as fewer and fewer firms pursue these sectors in recent years due to risk and fear of failure.

Asian Venture Capital Journal: [Video] Interview with Andrew Chung

Guardian: Paris climate change agreement: the world's greatest diplomatic success

In the final meeting of the Paris talks on climate change on Saturday night, the debating chamber was full and the atmosphere tense. Ministers from 196 countries sat behind their country nameplates, aides flocking them, with observers packed into the overflowing hall.

John Kerry, the US secretary of state, talked animatedly with his officials, while China’s foreign minister Xie Zhenhua wore a troubled look. They had been waiting in this hall for nearly two hours. The French hosts had trooped in to take their seats on the stage, ready to applaud on schedule at 5.30pm – but it was now after 7pm, and the platform was deserted.

Huffington Post: Pop Star Investor -- VC Turns Down 3 Record Deals to Help Save the World

What do Grammy-winning singer-songwriter John Legend and independent hop-hop artist Hoodie Allen have in common?

Besides being alumni of the University of Pennsylvania, they are both defectors from the corporate world, with the former leaving Boston Consulting Group in favor of a career in music, and the latter from Google.

While few can claim to rival Legend and Allen's daring career changes, fellow Penn alumnus Andrew Chung has a rare - and somewhat antithetical - story. The self-taught pop singer turned down multiple backing offers from record companies and artists in order to pursue life as a venture capital partner in Silicon Valley.

财新:钟子威-硅谷顶级风投眼中的中国机会

新华社:科斯拉创投人钟子威-微小的变化足以颠覆一切

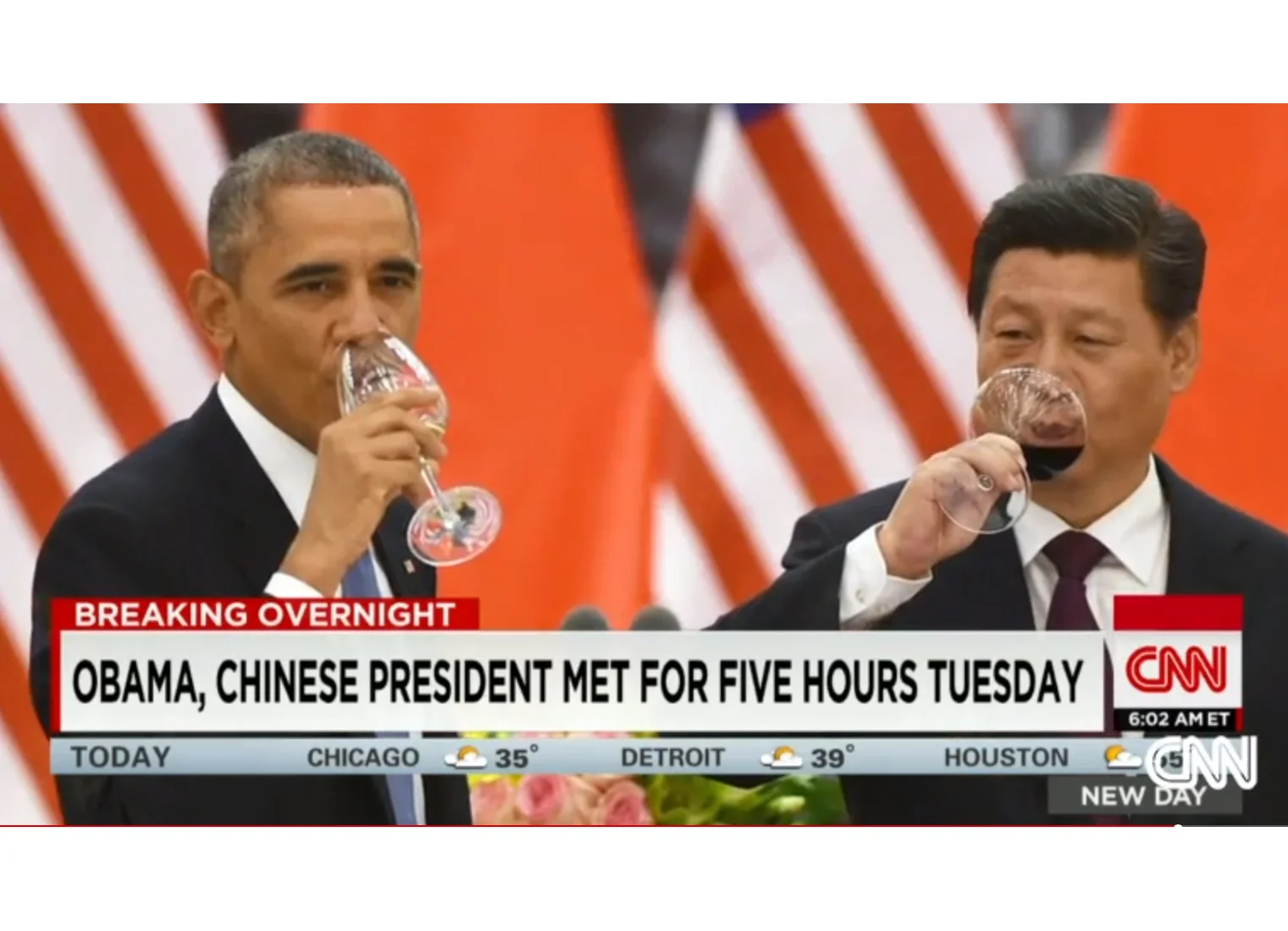

CNN: U.S. and China reach historic climate change deal, vow to cut emissions

In a historic climate change deal, U.S. President Barack Obama and Chinese President Xi Jinping announced both countries will curb their greenhouse gas emissions over the next two decades.

Under the agreement, the United States would cut its 2005 level of carbon emissions by 26% to 28% before 2025. China would peak its carbon emissions by 2030 and will also aim to get 20% of its energy from zero-carbon emission sources by the same year.

Huffington Post: Climate Change Response: How to Keep Cleantech Fire Burning

With climate change now officially a real and present danger, attention is turning back to the promise of clean energy and cleantech. It's no secret that cleantech has taken a bashing in the last few years, yet Andrew Chung is still bullish about the sector's prospects and convinced that it makes sense long-term, both domestically and globally. Khosla is one of the few venture capital companies still heavily committed to cleantech investment. During our recent hour-long conversation, he admits that "keeping the cleantech fire burning" is the first thing he thinks about when he wakes in the morning. He argues that if cleantech is not supported here in the United States, it will leave our shores.

Asian Venture Capital Journal: Profile - Andrew Chung, Silicon Valley VC

Andrew Chung passed up a chance at becoming a Hong Kong pop star for a career in VC investing. Now he is helping start-ups commercialize new energy technologies in Asia

In 2002, 24-year-old Andrew Chung returned to Hong Kong from the US and began plotting his career path. He applied for positions with several consulting firms, including Bain & Company. He also entered a scalable singing competition - New Talent Singing Awards.

The Economist: Red light, green light - China’s anti-pollution drive will make it a good place for clean-energy firms

“ENVIRONMENTAL pollution has become a major problem, which is nature’s red-light warning.” Those green-tinged words do not come from an activist. Rather, they come from China’s leaders, who gathered this week in Beijing for a big annual meeting. On March 5th Li Keqiang, the prime minister, vowed to declare war on pollution.

The timing could not have been better, then, for the launch of a firm devoted to the manufacture of greener engines. The same day EcoMotors, a startup backed by Bill Gates and Khosla Ventures, unveiled its joint venture with a division of China FAW Group, a local carmaker. The Chinese partner vowed to spend more than $200m on a factory in Shanxi, a northern province, that will produce 100,000 of the new engines a year.

Cleantech Insights: Exploring Decentralization with Andrew Chung

Cleantech: We’re looking forward to having you participate in Cleantech Forum San Francisco 2014. As you know, the theme is Accelerating system change: towards a decentralized future. Can you tell us about some of the changes you’re seeing underway in our energy and resource systems?

Andrew: We’ve believed for a long time that solving the world’s energy and resource problems will require a broad approach – no single technology or central institution can solve the problem alone, and it will require enterprises and consumers to each play an active role.

VentureBeat: How a Chinese restaurant, Hong Kong idol, and fatherhood shape Andrew Chung’s VC philosophy

“I wanna be a billionaire so freakin’ bad …”

When he sings the song “Billionaire,” Andrew Chung is different. Unlike you or me, he has a pretty good shot at making the words come true. That’s because Chung is a partner at Khosla Ventures, one of the most idiosyncratic and powerful venture capital firms in Silicon Valley.

“Buy all the things I never had …”

But he’s also different because the man can actually sing pretty well. He’s such a good vocalist, in fact, that he was a finalist in a major musical competition — Hong Kong Idol in 2002 — and was offered a contract from one of Asia’s biggest record labels.

He could have been a star.

Pando Daily: [Video] Andrew Chung is a VC trying to change how we recharge

In the tech world, no one gets a bad rap like the venture capitalist. Often derided as opportunists and gold diggers who take advantage of passionate and eager startups with unfavorable valuations, some entrepreneurs see VCs as a necessary evil to scale their disruptive idea to a national or global stage. Sometimes, though, these VCs are the greatest allies and closest advisors to the founders. They are often the unsung heroes who fuel and guide innovation.

Still, with the cost of starting and operating a company dropping precipitously, where do Venture Capitalists fit in, if at all? How can they bring value to an up-and-coming business? As every aspect of our lives -- and how we do business -- changes from the impact of technology and the Internet, so must financing all of these disruptive dreams.

![Asian Venture Capital Journal: [Video] Interview with Andrew Chung](https://images.squarespace-cdn.com/content/v1/56ad88b63b0be36169d74fae/1454315568265-A3PR7VUQE3IKYE5GNA5B/image-asset.png)

![Pando Daily: [Video] Andrew Chung is a VC trying to change how we recharge](https://images.squarespace-cdn.com/content/v1/56ad88b63b0be36169d74fae/1454346265520-JEGB2SOJ8JZ90GG6N259/image-asset.jpeg)