Food technology company Nature’s Fynd has secured a new round of funding led by 1955 Capital, Andrew Chung’s global venture capital firm. Generation Investment Management, LLP, and Breakthrough Energy Ventures also made substantial contributions to the $80 million in new funding

GreenBiz: This is Climate Tech

Agfunder: Agri-foodtech VCs assess Covid-19’s impact on the sector and portfolios

Agfunder: Nature’s Fynd rebrands from Sustainable Bioproducts raising $80M Series B to launch new protein food products

Sustainable Bioproducts, the startup that’s using a microbe discovered in Yellowstone National Park to manufacture alternative protein food products, has rebranded to Nature’s Fynd and raised $80 million in Series B funding. Nature’s Fynd is set to release a range of food products from breakfast and lunch through to snacks and dinner made from its proprietary microbe-produced protein, dubbed Fy, which contains all nine essential amino acids, as well as dietary fiber, calcium, and vitamins.

Greenbiz: Gore, Gates funds lead $80M round for protein startup born in Yellowstone hot springs

Many established alternative protein upstarts — including Impossible Foods and Beyond Meat — draw on plants as the feedstock for their innovations. Nature’s Fynd (formerly known as Sustainable Bioproducts) draws on a fermentation process linked to unique microbes that live in the geothermal hot springs of Yellowstone National Park.

SCMP: US alternative meat start-up Nature’s Fynd, backed by Jack Ma, Bill Gates, gets new funding from Al Gore as it targets Chinese market

Yahoo Finance: Andrew Chung's 1955 Capital Invests in Food Tech Innovator Nature's Fynd's Latest $80M Financing

1955 Capital, a global venture capital firm headed by Andrew Chung, has announced that it is making a substantial investment again in the food tech company, Nature's Fynd. The company announced today that it has raised $80 million in new funding with both Generation Investment Management LLP and Breakthrough Energy Ventures leading the round. Nature's Fynd, formerly Sustainable Bioproducts, was founded in 2012 with the mission of producing nutritional food products that are kind to the environment without using animals. Nature's Fynd will use the investment funds to scale its technology and operations in order to commercialize its products with minimal environmental impact.

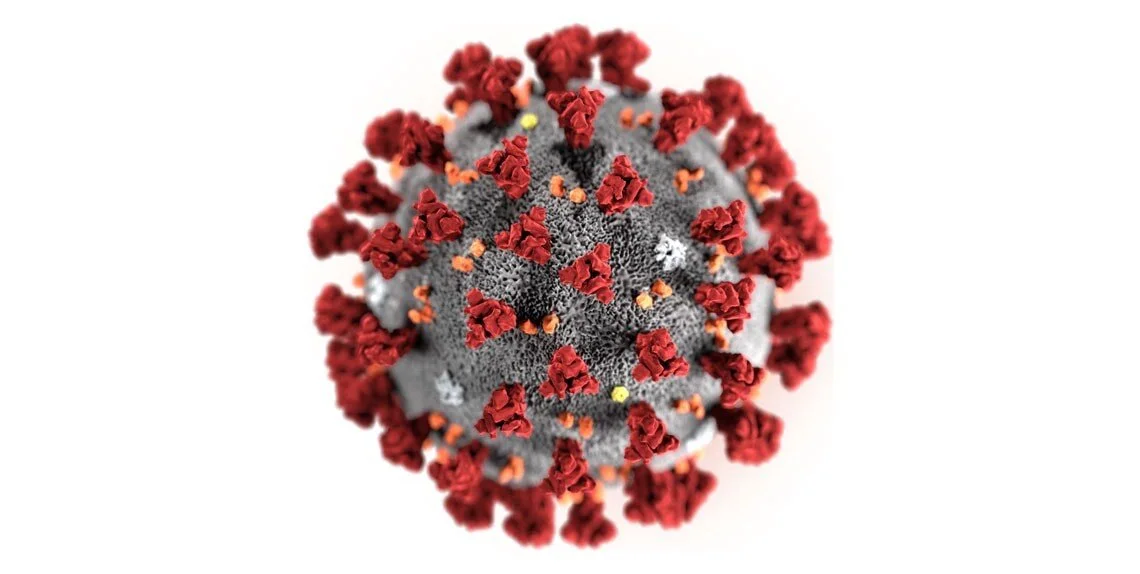

The Need for Strong Leadership Through COVID-19

On behalf of the 1955 Capital team, I’m hopeful that you, your team, and your family are staying safe amid the minute-by-minute evolution of the COVID-19 crisis. Over the past week, we have been in close dialogue with our portfolio companies about the coronavirus situation. More specifically, how its unprecedented nature heightens the importance of solid leadership, good decision-making, and thorough scenario-planning through this crisis.

Having lived in Greater China and advised companies during the 2002–04 SARS outbreak, I know firsthand how a pandemic can dramatically slow businesses down and force a rethinking of their strategies. But I have also seen companies prepare themselves well and come out of a crisis stronger than before. By managing through the situation with prudence and calm, our hope is that companies will invent ways to emerge on the other side of this in an advantaged position relative to their competitors and be ahead of the curve when the market turns.

In taking stock of some of the challenges and opportunities in front of 1955’s portfolio companies, my team and I humbly suggest that our CEOs consider a few major points as they press on during these trying times.

Andrew Chung & 1955 Capital, a New Fund to Bridge China, U.S.

Crop Enhancement Raises $8m Series B

A little more than three years after raising an $8.5m Series A, San Jose-based Crop Enhancement has raised an $8 million Series B. The round brings new partners to the table including Spruce Capital and Xeraya Capital, which led the round, Davinia Investments, and Alexandria Ventures. Existing investors 1955 Capital, Phoenix Venture Partners, and Wilbur Ellis’ Cavallo Ventures also re-upped their investments.

“What makes Crop Enhancement distinctive is the elegance of the solution and wide application across multiple crop types. They’re the first company that 1955 Capital has seen with true potential to solve the holy grail problem of protecting and boosting crop yield—by as high as 20-30% in some trials—while reducing the need for synthetic pesticides or pesticide applications,” Andrew Chung, founder and managing partner of 1955 Capital wrote to AFN via email. “Conventional chemical inputs are facing extreme regulatory pressure and it is only a matter of time before safer, softer approaches like Crop Enhancement’s become the norm.”

1955 Capital’s Andrew Chung: Why ClimateTech Is Heating Up in Venture Capital

“Cleantech lagged because consumers and enterprises didn’t take climate change seriously enough for it to impact their spending,” Chung said. “Now that it is seen as an existential threat to the planet, there is more urgency about solving it by consumers, corporations, governments, and investors. It’s a perfect storm.”

1955 Capital Promotes Kathy Chen to Vice President

1955 Capital Adds Private Equity Finance Veteran Jim Hinson as Chief Financial Officer

Gridtential Energy and Crown Battery Build New Silicon Wafer Battery that Combines the Best of Lead and Lithium-ion Performance

Using technology similar to a solar cell, Gridtential Energy's breakthrough Silicon Joule™ technology allows batteries to deliver up to 5X the power density with up to a 40% weight reduction - and it can be manufactured in current lead battery plants.

Silicon Joule™ technology replaces the lead-grid and cell connecting, lead-strap material inside a traditional lead battery with a treated silicon wafer. Gridtential is licensing the technology, enabling manufacturing partners to easily adapt their factories to provide high performing, higher voltage 24V & 48V batteries to their customers, without giga-scale capital investments.

South China Morning Post: The world’s biggest pork eaters are developing a palate for beef and other substitutes

China’s pork consumption has probably peaked, as consumers are opting for a healthier and a more varied diet.

Andrew Chung, founder of 1955 Capital which led Sustainable BioProducts’s financing round in February that included an investment from US billionaire Bill Gates’ fund, said there is definitely a role for alternative protein in a market like China.

“Not only is there a massive supply gap owing to the ongoing African swine fever, but in a country [affected by] food safety concerns and scandals, there is clear demand for a clean, traceable source of protein in food production,” he said.

South China Morning Post: Is the world’s biggest pork consumer ready for substitutes, as African swine fever burns a path through China’s hog herds?

Chicago-based Sustainable Bioproducts could provide a substitute protein to help China cope with pork shortages as a virus threatens to halve the nation’s hog industry this year, according to two board members at the start-up.

Andrew Chung, a board member of Sustainable Bioproducts and founder of the venture capital firm 1955 Capital, said the company expects a full-scale commercialisation of their product platform in the next 12 to 18 months, and is currently working on gaining regulatory approvals in the US.

“There is definitely a role for alternative protein in a market like China,” said Chung. “In a country where there are constant food safety concerns and scandals, there is a clear survival-driven demand for a clean, traceable source of protein in food production.”

AgFunder: This volcanic microbe startup is taking on Beyond Meat and Impossible in plant-based race

With big-name CVC investors like ADM Ventures and Danone Manifesto Ventures, Sustainable Bioproducts is preparing to unveil new plant-based product offerings targeting what it describes as the white space in the plant-based segment.

It was only a matter of time before companies started to emerge from Beyond Meat and Impossible Foods’ titanic shadows.

“In terms of why we are throwing our hat in the ring, there is so much opportunity and Beyond Meat and Impossible Foods have by no means taken over the market,” Karuna Rawal, chief marketing officer at Sustainable Bioproducts (SBP), told AFN. “We think we will have a differentiated offering that will make us a very viable competitor in the space.”

Bloomberg: Do These Tiny Organisms Hold the Key to Lab-Grown Food?

Scientists have long been captivated by a group of microscopic organisms in Yellowstone National Park. The microbes thrive at extreme temperatures and can efficiently multiply with limited resources. The feat has inspired a company called Sustainable Bioproducts, which is replicating the process in a laboratory and eventually, it hopes, at a large scale.

On Monday, the Chicago-based startup said it raised $33 million to accelerate the research. Venture firm 1955 Capital led the round, which also included Breakthrough Energy Ventures, a climate-focused technology fund backed by a roster of billionaires including Amazon.com Inc.’s Jeff Bezos and Microsoft Corp.’s Bill Gates. Michael Bloomberg, the founder and majority owner of Bloomberg LP, is also an investor in the fund.

Business Insider: A food startup backed by 2 industry giants is diving into the alt-meat market

A new kind of 'super protein' startup launched on Monday with $33 million backing from Silicon Valley VC firm 1955 Capital and the venture arms of two global food companies. The raw materials for its approach came from research done deep inside Yellowstone's volcanic hot springs, where organisms must adapt to a barren environment. The startup, called Sustainable Bioproducts, claims it can brew up high quantities of its product while having a minimal impact on the environment.

Forbes: Cavallo Ventures Makes Seven Figure Investment In Pesticide Disruption

Cavallo Ventures, the venture capital arm of global agribusiness company Wilbur-Ellis, has just announced an investment in 1955 portfolio company Crop Enhancement. The California-based company makes CropCoat, a unique protective coating being touted as an alternative to more toxic pesticides on the market.